Ultimate Amazon Vendor Central Guide: 2025 Edition

Table of Contents

Introduction to Amazon Vendor Central

Amazon Vendor Central is an invitation-only platform that enables manufacturers, brands, and distributors to sell their products directly to Amazon as a wholesaler. Unlike the more accessible Seller Central, Vendor Central operates on what’s known as the first-party (1P) selling model. In this arrangement, Amazon purchases products directly from vendors at wholesale prices and then resells these items to consumers as the retailer.The distinctive feature of products sold through Vendor Central is that they appear with the “Ships from and sold by Amazon.com” label, which can significantly enhance consumer trust and product credibility. This wholesale relationship fundamentally changes how businesses interact with Amazon’s marketplace compared to third-party sellers.

Vendor Central is exclusively available through Amazon’s invitation process, making it a selective program typically reserved for established brands and manufacturers with proven track records or unique product offerings. Amazon carefully evaluates potential vendors based on various factors including product demand, brand reputation, and business scalability.The platform primarily serves mid-to-large sized businesses that can reliably fulfill bulk purchase orders and maintain consistent inventory levels to meet Amazon’s demands. These typically include national or global brands, established manufacturers, and authorized distributors who prefer a wholesale business model over direct-to-consumer sales.Within Amazon’s ecosystem, Vendor Central represents the company’s traditional retail business model.

While third-party sellers through Seller Central now account for over 60% of Amazon’s physical product sales (Amazon, 2025), the Vendor Central program remains crucial for Amazon’s ability to offer products directly to consumers, especially for major brands that prefer wholesale relationships over marketplace selling.By operating through Vendor Central, vendors essentially become suppliers to Amazon rather than sellers on Amazon, creating a fundamentally different relationship with both the platform and end consumers. This distinction carries significant implications for pricing control, inventory management, and overall business strategy that we’ll explore throughout this guide.

Benefits of Using Vendor Central

Amazon Vendor Central offers numerous advantages for brands and manufacturers looking to scale their operations through Amazon’s wholesale model. Understanding these benefits can help businesses determine if this invite-only platform aligns with their growth strategy.

Streamlined Operations

One of the most significant advantages of Vendor Central is the operational simplicity it provides. When you become a vendor, Amazon handles the entire fulfillment process, including warehousing, packaging, shipping, and customer service. This arrangement allows brands to focus on what they do best—creating quality products—while Amazon manages the retail experience.According to case studies from successful vendors, this operational streamlining can lead to significant time and resource savings. Many brands report being able to redirect internal resources from logistics management to product development and marketing after transitioning to Vendor Central (Amazon, 2023).

Enhanced Product CredibilityProducts sold through Vendor Central carry the coveted “Ships from and sold by Amazon.com” badge. This designation significantly boosts consumer trust and often leads to higher conversion rates. Customers tend to have more confidence in products directly sold by Amazon, which can be particularly valuable for newer brands looking to establish credibility in the marketplace.

Access to Premium Marketing ToolsVendors gain exclusive access to marketing features not available to third-party sellers, including:

- A+ Content (enhanced product descriptions with rich media)

- Amazon Vine program (for generating trusted reviews)

- Amazon Marketing Services (AMS) with advanced advertising options

- Participation in Amazon’s promotional events like Prime Day and Lightning Deals

- Subscribe & Save program eligibility

These tools can significantly enhance product visibility and conversion rates. Case studies from Seller Labs show that brands utilizing these advanced marketing features have seen up to 300% growth in quarterly sales compared to their performance on standard seller accounts (Seller Labs, 2023).

Bulk Purchase Orders and Predictable Revenue

Unlike the unit-by-unit sales model of Seller Central, Amazon Vendor Central operates on bulk purchase orders. This wholesale approach provides more predictable revenue streams and simplifies inventory planning. Vendors receive purchase orders directly from Amazon, often for substantial quantities, allowing for more efficient production scheduling and cash flow forecasting.

Simplified International Expansion

Vendor Central facilitates easier international expansion through Amazon’s global network. Once established as a vendor, brands can more readily extend their reach to additional Amazon marketplaces worldwide. Amazon handles the complexities of international selling, including currency exchange, local compliance, and cross-border logistics, removing significant barriers to global expansion.

Dedicated Vendor Support

Vendors often receive support from Amazon vendor managers who provide strategic guidance and help resolve issues. This personalized support can be invaluable for navigating Amazon’s ecosystem and optimizing vendor performance. Larger vendors may even be assigned dedicated account managers who offer tailored recommendations for growth opportunities.While Vendor Central offers these substantial benefits, it’s important to note that they come with trade-offs in terms of pricing control and margins. The decision to pursue Vendor Central should align with your brand’s overall distribution strategy and growth objectives.

Who Can Use Vendor Central?

Amazon Vendor Central is an exclusive, invite-only platform that isn’t available to all sellers. Unlike Seller Central, which is open to virtually anyone who wants to sell on Amazon, Vendor Central access is tightly controlled by Amazon and extended only to selected businesses that meet specific criteria.

The Invite-Only Nature of Vendor Central

Amazon carefully selects which companies receive invitations to Vendor Central. These invitations typically come directly from Amazon’s retail team, who identify potential vendors through various channels, including existing marketplace performance, industry reputation, and product innovation. As noted by Rithum, “Amazon Vendor Central is an invite-only program where brands sell their products wholesale to Amazon, who then resells them to customers. (rithum.com)

Types of Businesses Amazon Typically Invites

Amazon generally extends Vendor Central invitations to the following types of businesses:

- Established brands with significant market presence

- Manufacturers who can reliably fulfill large purchase orders

- Distributors with exclusive rights to desirable products

- High-performing Seller Central merchants with consistent sales records

- Businesses with unique or innovative products that Amazon wants exclusive retail rights to

Minimum Requirements for Consideration

While Amazon doesn’t publicly disclose all criteria for Vendor Central selection, industry experience suggests several factors influence their decision:

- Proven sales history (often $1M+ in annual revenue)

- Operational capacity to handle bulk orders

- Strong brand recognition or unique product offerings

- Ability to meet Amazon’s strict compliance standards

- Competitive wholesale pricing structure

According to Be Bold Digital, “To receive timely payments, vendors must follow Amazon’s strict invoice submission guidelines,” which indicates the level of operational compliance expected from potential vendors. (bebolddigital)

How to Increase Your Chances of Getting an Invitation

If your business aspires to join Vendor Central, consider these strategies to improve your visibility to Amazon’s retail team:

- Build a successful track record on Seller Central with consistent sales volume and excellent customer feedback

- Develop unique products with demonstrable market demand

- Attend industry trade shows where Amazon buyers often scout for new vendors

- Network with Amazon retail team members at industry events

- Ensure your business infrastructure can support wholesale operations

- Optimize your brand presence both on and off Amazon

Alternatives for Businesses That Don’t Qualify

If your business hasn’t received a Vendor Central invitation, several viable alternatives exist:

- Amazon Seller Central: The 3P marketplace allows you to sell directly to customers while maintaining control over pricing and inventory

- Amazon Brand Registry: Provides enhanced brand protection and marketing tools for registered trademark owners

- Hybrid approach: Some businesses successfully operate on both Seller Central and Vendor Central platforms for different product lines

- Wholesale to existing Vendor Central partners: Supply your products to distributors who already have Vendor Central access

- Focus on building your brand: Continue growing your business to become more attractive to Amazon’s retail team in the future

Remember that Vendor Central isn’t necessarily the best fit for every business. Many companies achieve greater profitability and flexibility through Seller Central, especially those who value control over pricing and direct customer relationships.

The Vendor Central Application Process

Unlike many other e-commerce platforms, Amazon Vendor Central maintains its exclusivity through an invitation-only application process. Understanding how this system works is crucial for brands hoping to transition to this wholesale model.

How Invitations are Extended

Amazon typically extends Vendor Central invitations to established brands and manufacturers based on several factors: Strong sales performance on Amazon Seller Central Unique or high-demand products that fill gaps in Amazon’s catalog Established brands with proven market presence Manufacturers with reliable supply chain capabilities

According to Salsify, “Amazon Vendor Central is a digital portal that allows vendors to sell directly to Amazon itself through the first-party (1P) selling module.” This invitation often comes via email from an Amazon representative who sees potential in your brand becoming a wholesale supplier to Amazon. salsify

Required Documentation and Information

Once invited, vendors must prepare comprehensive documentation including:

- Business registration and tax documents

- Bank account information for payment processing

- Product catalog with detailed specifications UPC/EAN codes for all products

- Pricing structure and wholesale terms

- Distribution agreements or exclusivity rights (if applicable)

- Onboarding Process

The onboarding process typically follows these stages:

- Initial Assessment: Amazon evaluates your brand and product line

- Contract Negotiation: Terms, margins, and payment schedules are discussed

- Documentation Submission: Providing all required business and product information

- Account Setup: Creation of your Vendor Central portal access

- Training: Orientation to the platform’s features and requirements Account Setup Steps

Setting up your Vendor Central account involves several critical steps:

- Completing your company profile with accurate business information

- Setting up payment methods and tax details

- Uploading product catalog information and digital assets

- Configuring shipping and fulfillment preferences

- Establishing EDI (Electronic Data Interchange) connections if required Common Challenges During Application

Many potential vendors face obstacles during the application process, including:

- Negotiating favorable payment terms (standard terms can be challenging)

- Meeting Amazon’s strict product information requirements

- Adapting to Amazon’s preferred pricing structure Understanding complex contractual terms

As noted by FLXPoint, “Payment terms usually range from 60 to 90 days after Amazon receives your inventory. Some vendors might negotiate better terms, but this is the standard timeframe.(Fixpoint)

Timeline Expectations

The timeline from invitation to active vendor status varies significantly:

- Application Review: 1-2 weeks

- Contract Negotiation: 2-4 weeks

- Account Setup: 1-2 weeks

- Initial Purchase Order: 2-4 weeks after account approval

The entire process typically takes 1-3 months, depending on your readiness, responsiveness, and Amazon’s current onboarding volume. Patience and thorough preparation are essential for successfully navigating the Vendor Central application process.

How It Differs from Seller Central

Understanding the key differences between Amazon Vendor Central and Seller Central is crucial for businesses deciding which platform aligns better with their sales strategy. The most fundamental distinction lies in the business model: Vendor Central operates on a first-party (1P) model, while Seller Central uses a third-party (3P) model.

1P vs. 3P Business Models

In the Vendor Central (1P) model, you sell your products wholesale to Amazon, which then resells them to customers. Your relationship with Amazon is that of a supplier to a retailer. With Seller Central (3P), you sell directly to consumers through Amazon’s marketplace, maintaining your role as the retailer while Amazon serves as the platform facilitating the transaction.According to DCL Logistics, “The most important difference between Amazon Vendor Central and Amazon Seller Central is the point of contact who actually sells your products.” In Vendor Central, products appear as “Ships from and sold by Amazon.com,” while in Seller Central, they show as “Sold by [Your Business Name].”

Control Over Pricing and Inventory

One of the most significant operational differences concerns control over pricing and inventory:

- Vendor Central: Amazon controls retail pricing, often adjusting prices to remain competitive. Vendors have limited influence over these decisions. Amazon also determines inventory levels by issuing purchase orders based on their algorithms and demand forecasts.

- Seller Central: Sellers maintain complete control over pricing strategies and can adjust prices at any time. They also manage their own inventory levels, deciding when and how much to restock. Fee Structures and Payment Term

The financial arrangements differ substantially between two platforms:

Vendor Central: Operates on a wholesale model where Amazon purchases products at negotiated prices. Payment terms typically range from 60-90 days after invoice receipt. Vendors may face additional costs such as chargebacks for non-compliance with Amazon’s requirements.

Seller Central: Sellers receive payment for each sale, minus Amazon’s referral fees (typically 8-15% depending on category) and any fulfillment fees if using FBA. Payments are disbursed every two weeks, offering better cash flow than the vendor model.Mayple notes that “Vendor Central’s payment terms can be challenging for smaller businesses with limited cash flow, as Amazon typically pays within 60-90 days of receiving inventory.” 2

Marketing and Promotional Opportunities

Both platforms offer marketing tools, but with different scopes:

- Vendor Central: Provides access to exclusive marketing programs like A+ Content, Amazon Vine for reviews, and Amazon Marketing Services (AMS) with enhanced advertising options. Vendors may also participate in Amazon’s deal programs like Lightning Deals and Prime Day promotions.

- Seller Central: Offers Amazon Advertising (formerly Seller Central advertising), A+ Content (now available to brand-registered sellers), and participation in deals. However, some advanced marketing features remain exclusive to vendors.

Customer Service Responsibilities

The division of customer service duties varies significantly:

- Vendor Central: Amazon handles all customer service, including inquiries, returns, and refunds. This reduces operational burden but limits direct customer interaction.

- Seller Central: Sellers are responsible for customer service, either handling it themselves or delegating it to Amazon through FBA. This creates more work but allows for direct customer relationships and feedback.

Reporting and Analytics Differences

Both platforms provide analytics, but with different focuses:

- Vendor Central: Offers retail analytics focused on wholesale performance, including forecasting tools, inventory health, and returns analysis. Reports tend to be less detailed and updated less frequently than in Seller Central.

- Seller Central: Provides more comprehensive, real-time data on sales, inventory, customer behavior, and advertising performance. This granular data allows for more agile decision-making.

The choice between Vendor Central and Seller Central ultimately depends on your business model, resources, and priorities. Larger manufacturers with established brands often prefer the hands-off approach of Vendor Central, while businesses seeking greater control over their Amazon presence typically favor Seller Central. Many successful Amazon businesses actually employ a hybrid strategy, using both platforms strategically for different product lines or markets.

Key Features for B2B Sellers

Amazon Vendor Central offers a robust suite of features specifically designed for B2B sellers looking to scale their wholesale operations. These tools help streamline operations, improve efficiency, and drive revenue growth through Amazon’s massive marketplace.

Bulk Ordering Capabilities

One of the most significant advantages of Vendor Central for B2B sellers is the ability to fulfill large purchase orders from Amazon. Unlike the unit-by-unit sales common in Seller Central, Vendor Central operates on a wholesale model where Amazon places bulk orders based on their inventory needs and projected consumer demand. This allows manufacturers and distributors to benefit from economies of scale in production and shipping.According to Enceiba, “Amazon Business enables sellers to offer quantity discounts on eligible products. And it enables sellers to offer bulk purchase options to” business customers, creating additional revenue opportunities for vendors who can efficiently manage large-volume orders. (Enceiba)

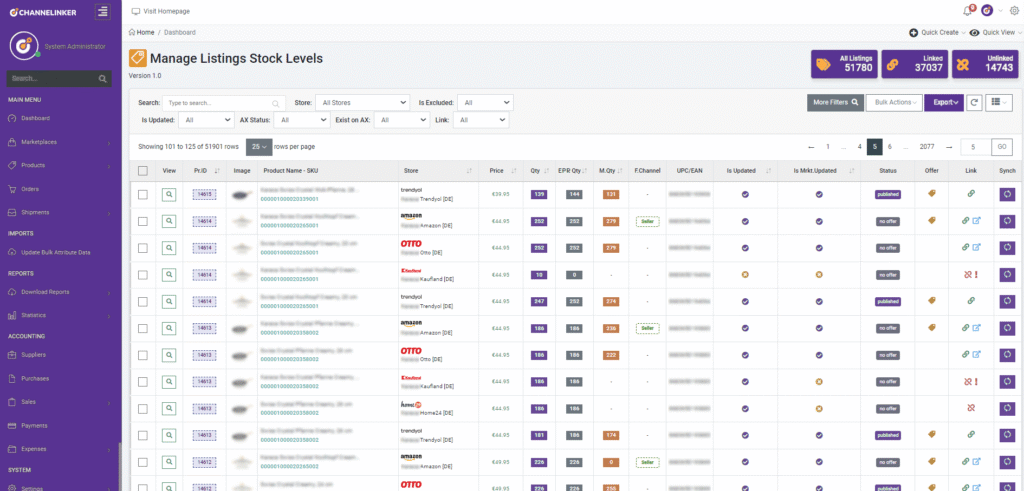

EDI (Electronic Data Interchange) Integration

For enterprise-level B2B sellers, Amazon Vendor Central offers robust EDI integration capabilities that automate the exchange of business documents such as purchase orders, invoices, and shipping notices. This integration eliminates manual data entry, reduces the risk of errors, and accelerates order processing times—critical advantages for high-volume B2B transactions.

EDI integration allows vendors to connect their existing enterprise resource planning (ERP) systems directly with Amazon’s ordering system, creating a seamless flow of information that enhances operational efficiency and reduces administrative overhead. With EDI, all relevant documents are transferred electronically in standardized formats, ensuring consistency and reliability across business transactions.

How Channelinker Enhances EDI and ERP Integration

Channelinker takes this automation a step further by providing a centralized EDI and ERP integration module that bridges the gap between your internal systems and Amazon Vendor Central. With Channelinker, B2B sellers can:

- Connect multiple ERPs, WMS, and accounting systems to Amazon and other marketplaces simultaneously, ensuring all data flows seamlessly between platforms.

- Automate the end-to-end exchange of purchase orders, shipping notifications, and invoices across your entire sales network—not just with Amazon, but also with other B2B or retail partners.

- Gain real-time visibility into order status, document processing, and transaction history within a single, unified dashboard.

- Reduce IT maintenance and manual intervention by utilizing Channelinker’s managed EDI connectors and customizable workflows, which adapt to your business’s unique needs.

By implementing EDI integration through Channelinker, enterprise sellers can achieve higher accuracy, faster processing times, and scalable growth—making it easier to meet Amazon’s stringent requirements and exceed customer expectations.

If you are seeking to streamline your enterprise integrations and unlock true B2B efficiency, explore Channelinker’s EDI and ERP automation solutions or contact our team for a tailored demo.

Vendor Negotiations

Vendor Central provides a structured framework for negotiating terms with Amazon, including wholesale pricing, promotional funding, and marketing support. B2B sellers can work with their Amazon Vendor Manager to establish favorable terms that protect margins while ensuring competitive retail pricing on the platform.These negotiations typically occur during annual vendor negotiations, where suppliers can discuss terms like freight allowances, damage allowances, and cooperative marketing agreements that can significantly impact profitability.

Payment Terms for Large Businesses

While standard payment terms in Vendor Central typically range from 30 to 90 days, large B2B sellers with significant volume can sometimes negotiate more favorable payment schedules. These extended terms help manage cash flow for businesses with substantial inventory investments.It’s worth noting that Amazon’s payment terms for vendors differ significantly from the bi-weekly disbursements common in Seller Central, requiring B2B businesses to adapt their financial planning accordingly.

B2B-Specific Analytics

Vendor Central offers sophisticated analytics tools designed specifically for wholesale businesses. These include detailed reports on inventory turns, sell-through rates, and forecasted demand that help B2B sellers optimize their production schedules and inventory management.As noted by SPCTek, “Amazon Vendor Central is a business-to-business platform where brands sell their products wholesale directly to Amazon,” and the platform provides analytics tailored to this wholesale relationship. (SPCTek) Inventory Forecasting Tools

Perhaps one of the most valuable features for B2B sellers is Amazon’s inventory forecasting capability. Vendor Central provides insights into projected demand, helping manufacturers plan production runs and maintain optimal inventory levels to fulfill Amazon’s purchase orders without excess stock.These forecasting tools leverage Amazon’s vast data resources to predict seasonal trends, identify emerging product opportunities, and alert vendors to potential stock-out situations before they occur. This predictive capability is particularly valuable for B2B sellers with complex supply chains or long production lead times.

Marketing and Merchandising Support

B2B sellers in Vendor Central gain access to exclusive marketing programs like Amazon Vine for product reviews, A+ Content for enhanced product descriptions, and Amazon Marketing Services (AMS) for sponsored product campaigns. These tools help increase product visibility and conversion rates, driving more wholesale orders from Amazon.Additionally, vendors can participate in Amazon’s various promotional events and deal programs, which can significantly boost product visibility and sales volume for B2B suppliers.

Navigating the Vendor Central Dashboard

The Amazon Vendor Central dashboard serves as the command center for all vendor operations, offering a comprehensive interface that allows brands to manage their wholesale relationship with Amazon. Understanding how to effectively navigate this dashboard is crucial for maximizing your success as an Amazon vendor.

Overview of the User Interface

When you first log into Vendor Central, you’re greeted with a clean, organized interface that provides access to all essential functions. The dashboard is designed with efficiency in mind, featuring a top navigation bar with dropdown menus for major sections like Orders, Items, Retail Analytics, and Marketing. The main dashboard area displays important notifications, pending actions, and performance metrics at a glance, allowing vendors to quickly identify areas requiring immediate attention.

Key Sections and Features

The Vendor Central dashboard is organized into several key sections that facilitate different aspects of the vendor-Amazon relationship:

- Orders: Access to purchase orders, shipping notifications, and order status updates

- Items: Product catalog management, including listing creation and optimization

- Retail Analytics: Comprehensive sales data, inventory metrics, and performance analytics

- Marketing: Access to advertising tools, A+ Content creation, and promotional opportunities

- Operations: Supply chain management, compliance requirements, and operational metrics Managing Purchase Orders

One of the most frequently used sections of the dashboard is the Purchase Orders area. Here, vendors can view incoming POs from Amazon, confirm or reject orders, create shipping notifications, and track order status. The system provides clear visibility into order deadlines, helping vendors maintain compliance with Amazon’s strict delivery requirements. According to SmartScout, effective inventory management through this dashboard is essential for maintaining a healthy vendor relationship with Amazon.

Reporting Tools

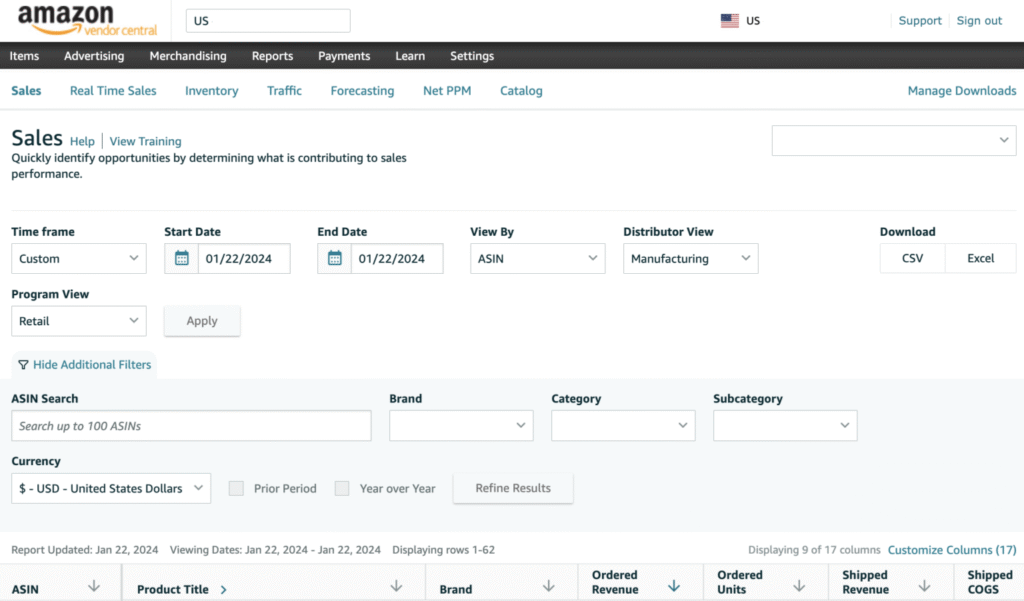

The Retail Analytics section offers powerful reporting capabilities that provide vendors with actionable insights. These reports cover sales performance, inventory levels, customer behavior, and operational metrics. Vendors can access detailed data on product performance, allowing for informed decision-making about inventory levels, pricing strategies, and promotional activities. ConsultERCE notes that “The Retail Analytics dashboard includes metrics about the commercial and operational performance of your vendor account,” making it an invaluable resource for strategic planning.Content Management

The Content section of Vendor Central allows brands to control how their products appear on Amazon. Here, vendors can upload and manage product images, create enhanced marketing content (A+ Content), and ensure product detail pages accurately represent their offerings. This area is crucial for brand representation and plays a significant role in conversion optimization.

Support Access

Vendor Central provides direct access to Amazon support through the Case Log system. Vendors can submit inquiries, report issues, and request assistance across various categories including orders, payments, catalog management, and technical support. The dashboard tracks all communication history, making it easy to follow up on outstanding issues and monitor resolution progress.

Common Troubleshooting

Even experienced vendors occasionally encounter challenges when navigating the Vendor Central dashboard. Common issues include:

- Purchase order discrepancies that require reconciliation

- Catalog errors affecting product visibility

- Payment disputes and chargeback challenges

- Content submission errors or delays Data access limitations in reporting

The dashboard provides troubleshooting resources and access to support teams that can help resolve these issues. According to Saras Analytics, Vendor Central provides “real-time sales analytics” and other tools that can help identify and address operational challenges before they impact your business performance.Mastering the Vendor Central dashboard is essential for any brand looking to succeed in the Amazon vendor program. By understanding its features and capabilities, vendors can streamline operations, improve performance visibility, and build a more profitable relationship with Amazon.

Managing Purchase Orders in Vendor Central

Purchase orders (POs) are the lifeblood of the vendor-Amazon relationship in Vendor Central. Understanding how to effectively manage these orders is critical for maintaining a profitable partnership with Amazon.

Understanding Amazon’s PO System

Amazon’s purchase order system operates differently from traditional retail models. POs are generated based on Amazon’s inventory forecasting algorithms, which analyze historical sales data, seasonal trends, and projected demand. As a vendor, you’ll receive these orders through your Vendor Central dashboard, where you can review, accept, or request modifications.According to Reason Automation,

“As an Amazon vendor, you drive profitability with three levers:

selling as much of your product to Amazon as possible,

minimizing chargebacks,

optimizing your wholesale pricing.”

This highlights the importance of efficient PO management as a core component of vendor success. (reasonautomation)

PO Types and Fulfillment Expectations

Amazon issues several types of purchase orders through Vendor Central:

- Regular POs: Standard orders based on Amazon’s inventory needs

- Rush POs: Urgent orders requiring expedited fulfillment

- New Item POs: Initial orders for newly added products

- Promotional POs: Orders tied to specific marketing events or promotions

Each PO type comes with specific fulfillment expectations. For regular POs, vendors typically have 1-2 weeks to fulfill, while rush orders may require shipment within 24-48 hours. Meeting these deadlines is crucial for maintaining your vendor performance metrics.

Handling Chargebacks

Chargebacks represent one of the most challenging aspects of PO management in Vendor Central. These penalties occur when vendors fail to meet Amazon’s strict requirements regarding shipment accuracy, timing, or packaging.Common chargeback types include:

- Late shipments

- Incomplete orders

- Incorrect packaging or labeling

- Missing or incorrect ASNs (Advanced Shipping Notices)

- Routing guide violations

To minimize chargebacks, implement robust inventory and shipping systems that ensure compliance with Amazon’s requirements. “Develop and maintain an inventory management system that provides detailed, real-time insights into inventory status,” advises Reason Automation (reasonautomation)

Negotiating Terms

While Amazon typically sets standard terms for vendors, there is often room for negotiation, particularly for established brands or high-volume suppliers. Key negotiable aspects include:

- Payment terms (net 30, 60, or 90 days)

- Freight allowances

- Marketing development funds

- Return policies

- Minimum order quantities

Successful negotiation requires data-driven arguments demonstrating mutual benefit. Keep detailed records of your fulfillment performance and sales growth to strengthen your position during term discussions.

Order Defect Management

Order defects can significantly impact your vendor performance metrics and future PO volume. Common defects include out-of-stock situations, partial shipments, and quality issues. To manage these effectively:

Implement quality control processes before shipping to Amazon Maintain clear communication about potential fulfillment issues Use the “Contact Us” feature in Vendor Central to address problems proactively Review and dispute inaccurate defect claims through the appropriate channelsAddressing defects promptly and transparently helps maintain a positive relationship with Amazon’s buying team.

Seasonal Inventory Planning

Seasonal fluctuations significantly impact PO volumes and timing. Effective vendors anticipate these changes through careful planning:”This guide will be a reference point for daily operations, avoiding potential pitfalls, and maximizing the potential of a partnership in Amazon Vendor Central,” notes a comprehensive guide on purchase order management, emphasizing the importance of strategic planning for seasonal demands. (blog.openbridge.com) To optimize seasonal inventory planning:

- Analyze historical data from previous seasons

- Communicate with Amazon’s buying team about upcoming promotions

- Build manufacturing flexibility to accommodate unexpected demand spikes

- Develop contingency plans for supply chain disruptions

- Consider using Amazon’s forecasting tools to align production schedules

By mastering purchase order management in Vendor Central, you can transform this critical operational process from a potential pain point into a strategic advantage, ensuring consistent inventory availability while minimizing costly penalties and disruptions.

Marketing and Advertising Options

Amazon Vendor Central provides vendors with exclusive marketing and advertising tools to enhance brand presence and drive sales. These options go beyond what’s available to third-party sellers, giving vendors unique advantages in the marketplace.

A+ Content

A+ Content (formerly known as Enhanced Brand Content) allows vendors to enhance their product listings with rich media and detailed descriptions. This premium content can significantly impact conversion rates and customer engagement:

- According to Amazon, basic A+ Content can increase sales by up to 8%, while well-implemented Premium A+ Content can boost sales by up to 20% (Amazon, 2023).

- A+ Content enables vendors to include enhanced images, comparison charts, videos, and detailed product descriptions.

- Premium A+ Content (available to select vendors) offers additional interactive modules like carousel displays, interactive product tours, and video loops.

The enhanced visual storytelling capabilities of A+ Content help vendors differentiate their products and communicate value propositions more effectively. Research shows that A+ Content can improve a product’s conversion rate by 5.6% (SellerApp, 2023).

Amazon Marketing Services (AMS)Vendor Central provides access to Amazon Marketing Services, a comprehensive advertising platform that includes:

- Sponsored Products: Pay-per-click ads that promote individual product listings within search results and on product detail pages.

- Sponsored Brands: Banner ads featuring your brand logo, custom headline, and multiple products that appear in search results.

- Sponsored Display: Self-service display ads that can reach relevant audiences both on and off Amazon.

- Amazon DSP (Demand-Side Platform): Programmatic advertising that reaches audiences across Amazon sites, apps, and third-party exchanges. Vendor Promotions

Vendors can participate in various promotional programs to increase visibility and drive sales:

- Deal of the Day: Featured promotions on Amazon’s Deal page for 24 hours.

- Lightning Deals: Time-limited promotions that appear on Amazon’s Deal page.

- Best Deals: Longer-running promotions that offer significant discounts.

- Coupons: Digital coupons that customers can clip and apply to purchases.

Amazon Vine Program

The Amazon Vine program is an invitation-only program that allows vendors to receive honest feedback from Amazon’s most trusted reviewers. Benefits include:

Access to a community of reliable reviewers who provide detailed, honest product feedback. Accelerated review generation for new products. Increased customer confidence through authentic reviews from verified Vine Voices.Brand Stores

Amazon Brand Stores allow vendors to create customized multipage stores to showcase their brand and product portfolio:

Fully customizable layouts with drag-and-drop tiles and widgets. Multiple pages to organize products by category, collection, or theme. Integration with advertising campaigns to drive targeted traffic. Analytics dashboard to track store performance and shopper behavior.These marketing and advertising options provide vendors with powerful tools to enhance brand visibility, communicate product value, and drive conversions on Amazon’s marketplace. By leveraging these exclusive features, vendors can create immersive shopping experiences that differentiate their products from competitors and build stronger connections with customers.

Pricing and Payment Terms

Understanding the pricing structure and payment terms is crucial for vendors considering Amazon Vendor Central. Unlike Seller Central, where you set your own retail prices, Vendor Central operates on a wholesale model with Amazon controlling the final customer-facing prices.

How Amazon Determines Retail Pricing

When you sell through Vendor Central, Amazon has complete control over retail pricing. They use sophisticated algorithms that consider factors like competition, demand, seasonality, and their own profit margins to set prices. This dynamic pricing approach means your products may sell at different price points throughout the year, sometimes below your suggested retail price (MSRP).

Understanding Wholesale Pricing Expectations

As a vendor, you’ll need to provide competitive wholesale prices to Amazon. The platform typically expects wholesale prices that allow them to maintain healthy margins while remaining competitive in the marketplace. Amazon often pushes for lower wholesale prices during negotiations, so understanding your cost structure and minimum viable pricing is essential before entering discussions.

Payment Schedules and Terms

Amazon Vendor Central payment terms can vary significantly based on your negotiation leverage and relationship with Amazon. Standard payment terms typically range from Net 30 to Net 90, with most vendors operating on Net 60 terms. This means Amazon pays invoices 60 days after receiving them. Some vendors may qualify for early payment discounts, such as 2% 30 Net 60, where Amazon takes a 2% discount if they pay within 30 days instead of the full 60-day term.According to recent discussions among vendors, Amazon has been pushing for extended payment terms, with some vendors reporting pressure to accept Net 90 terms, which many find challenging for cash flow management. As one vendor noted on Reddit, “90 days seems crazy” when discussing Amazon’s push for extended payment terms (Reddit, 2024).

Dealing with Deductions and Chargebacks

Vendors should be prepared for various deductions and chargebacks that Amazon may apply to invoices. These can include:

- Freight allowances

- Marketing co-op fees

- Damage allowances

- Non-compliance fees for packaging or labeling issues

- Shortages or overages in shipments

These deductions can significantly impact profitability, so careful monitoring of invoices and prompt dispute of incorrect chargebacks is essential. Some vendors report that Amazon’s payment terms and deduction practices can contribute to inventory shortages, as suppliers may limit shipments when payment terms become too extended (SupplierWiki, 2025).

Negotiating Better Terms

While Amazon often has significant leverage in negotiations, vendors with unique or high-demand products may be able to secure more favorable terms. Strategies for negotiation include:

- Demonstrating the unique value proposition of your products

- Providing data on sell-through rates and consumer demand

- Highlighting competitive advantages that benefit Amazon Building strong relationships with your Vendor Manager

- Being prepared to walk away if terms become unsustainable MSRP Considerations

While Amazon determines the final retail price, vendors can provide Manufacturer’s Suggested Retail Prices (MSRP). Though Amazon isn’t obligated to follow these suggestions, providing accurate MSRP information helps Amazon’s systems better understand your product’s value positioning. Some vendors use MAP (Minimum Advertised Price) policies, but enforcement can be challenging within the Amazon ecosystem.When setting wholesale prices, consider how Amazon’s pricing algorithms might affect your products’ perceived value and your relationships with other retail partners. Dramatic price differences between Amazon and other retailers can strain these relationships and potentially lead to channel conflict.

Reporting and Analytics

Amazon Vendor Central provides powerful reporting and analytics tools that give vendors deep insights into their business performance. These analytics capabilities are crucial for making data-driven decisions to optimize inventory, marketing, and sales strategies.

Retail Analytics

Retail Analytics (formerly known as Sales Diagnostics) is one of the most valuable reporting tools in Vendor Central. This comprehensive suite provides vendors with detailed sales data, inventory performance, and customer behavior insights. According to Acadia.io, these reports offer “granular visibility into sales performance, allowing vendors to track product movement across different timeframes and identify trends that impact business decisions” (Acadia.io, 2025).

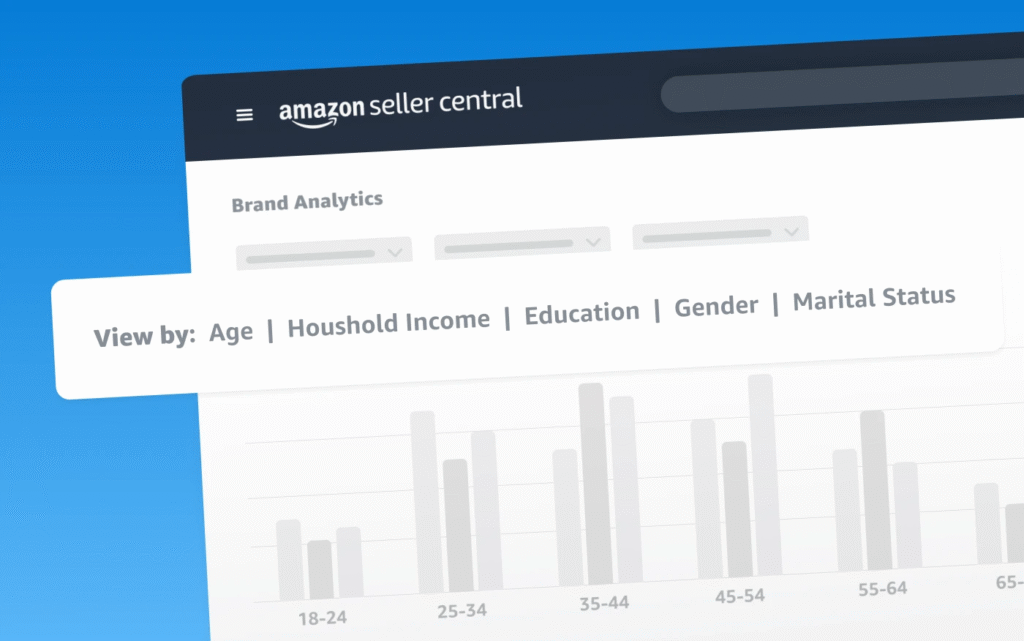

Amazon Brand Analytics Access

Vendors gain access to Amazon Brand Analytics, which provides valuable market intelligence including search term data, item comparison reports, and demographic information about customers. This tool helps vendors understand how shoppers discover and compare products, enabling more effective keyword targeting and product positioning.

Sales Performance Metrics

Vendor Central offers detailed sales performance metrics that track key indicators such as:

- Shipped COGS (Cost of Goods Sold)

- Shipped revenue

- Units sold

- Return rates

- Sell-through percentages

- Glance views and conversion rates

These metrics can be analyzed across different timeframes, allowing vendors to identify seasonal trends and measure the impact of promotional activities.

Inventory Health Reporting

Inventory reports in Vendor Central provide critical insights into stock levels, helping vendors maintain optimal inventory positions. These reports track in-stock rates, weeks of supply, and inventory turnover, allowing vendors to prevent stockouts and overstock situations that can impact profitability.

Customer Insights

The analytics suite includes customer behavior data that helps vendors understand purchasing patterns. ConsultErce notes that “vendors can access demographic information, review analysis, and repeat purchase behavior, providing a comprehensive view of the customer journey” (ConsultErce, 2025).

Competitive Analysis Tools

Vendor Central offers competitive analysis capabilities that allow vendors to benchmark their performance against category averages. While these tools don’t reveal competitor-specific data, they provide valuable context for understanding market position and identifying opportunities for growth.

Forecasting Capabilities

Advanced forecasting tools help vendors anticipate future demand based on historical sales data, seasonal trends, and upcoming promotions. These forecasts are essential for production planning, inventory management, and ensuring adequate stock levels during peak selling periods.By leveraging these robust reporting and analytics features, vendors can make informed decisions that drive growth, improve operational efficiency, and enhance their competitive position on Amazon’s marketplace.

Vendor Central in Global Markets

Amazon Vendor Central operates across multiple international markets, offering brands and manufacturers the opportunity to expand their wholesale operations globally. Understanding the regional differences and requirements is essential for vendors looking to succeed in international markets.

Regional Differences in Vendor Central Operations

Amazon’s Vendor Central platform varies significantly between regions, particularly between North America and Europe. According to Amazon’s own comparison, European operations often require additional considerations compared to the U.S. market. In Europe, vendors must navigate multiple country-specific marketplaces (UK, Germany, France, Italy, Spain, Netherlands, Sweden, and Poland) while the U.S. operation is centralized.

Multi-Country Management

When operating across multiple countries, vendors face unique challenges in inventory distribution and market-specific strategies. European vendors often benefit from the European Fulfillment Network (EFN), which allows inventory stored in one European country to serve customers across the continent. However, this requires careful planning to ensure adequate stock levels and efficient distribution across markets.

International Compliance Considerations

Each region has distinct regulatory requirements that vendors must meet. In Europe, vendors need to comply with VAT regulations, GDPR data protection rules, and country-specific product safety standards. Product labeling requirements also differ significantly between regions, with European products often requiring multi-language packaging and specific compliance markings like CE.

Currency and Payment VariationsPayment terms and currencies vary across global Vendor Central operations. According to XSellco, while U.S. vendors typically receive payments on 60-day terms, European payment schedules can vary by country. Currency fluctuations can also impact profitability, requiring vendors to implement strategic pricing models that account for exchange rate variations.

Language Support and Content Requirements

Content requirements differ significantly across regions. European vendors often need to provide product information in multiple languages, which increases the complexity of catalog management. A+ Content (enhanced marketing content) must be localized for each marketplace to maximize effectiveness, requiring additional resources for translation and cultural adaptation.

Regional Market Insights

Consumer preferences and purchasing behaviors vary widely across global markets. European shoppers often have different expectations regarding delivery times, product presentation, and customer service compared to U.S. consumers. Successful vendors adapt their strategies to these regional differences, optimizing product selection, pricing, and promotions based on local market conditions.For vendors considering global expansion through Amazon Vendor Central, a phased approach is often recommended. Starting with familiar markets that share similar characteristics to your home region can provide valuable experience before expanding into more challenging territories. Additionally, leveraging Amazon’s market insights and analytics tools can help identify promising opportunities and navigate the complexities of international wholesale operations.

Common Challenges and Solutions

While Amazon Vendor Central offers numerous benefits, vendors often encounter several challenges that can impact their business operations and profitability. Understanding these common pain points and their potential solutions is crucial for success on the platform.

Inventory Management Issues

Inventory management presents significant challenges for many vendors. Amazon’s ordering patterns can be unpredictable, with sudden spikes in purchase orders followed by extended periods without orders. This inconsistency makes production planning difficult and can lead to stockouts or excess inventory.

Solution: Implement robust forecasting tools that analyze historical data to predict Amazon’s ordering patterns. Maintain safety stock levels and develop contingency plans for rapid production scaling. Regular communication with your Amazon buyer about upcoming promotions or seasonal fluctuations can also help anticipate inventory needs.

Chargebacks and Deductions

Vendors frequently face unexpected chargebacks and deductions from payments for issues like packaging non-compliance, late deliveries, or routing guide violations. These charges can significantly impact profitability and are often difficult to dispute.

Solution: Create a systematic approach to reviewing all chargebacks, documenting evidence for disputes, and establishing a dedicated team member to manage this process. Implement strict quality control measures to ensure compliance with Amazon’s requirements, and regularly review Amazon’s routing guides and packaging specifications to stay current with their expectations.

Communication with Amazon Buyer Teams

Many vendors report difficulties in establishing consistent communication with their Amazon buyer teams. Responses can be slow or inconsistent, and frequent turnover among Amazon staff can disrupt established relationships.

Solution: Develop relationships with multiple contacts within your Amazon team rather than relying on a single point of contact. Schedule regular business reviews to discuss performance, challenges, and opportunities. Utilize the case management system within Vendor Central to document all communications and follow up consistently on unresolved issues.

Price Control LimitationsOne of the most frequently cited challenges is the lack of control over retail pricing. Amazon determines the final price to consumers, which can lead to margin erosion and conflicts with pricing strategies in other channels.

Solution: Focus on optimizing your wholesale cost structure to ensure profitability regardless of Amazon’s retail pricing decisions. Consider implementing MAP (Minimum Advertised Price) policies across all channels and communicate these clearly to Amazon. Develop exclusive product variations for Amazon to minimize direct price comparisons with other retailers.

Return Rate Management

High return rates can significantly impact profitability, especially since vendors often bear the cost of returns. Additionally, Amazon may reduce purchase orders for products with elevated return rates.

Solution: Analyze return reason codes to identify and address product issues. Improve product descriptions, images, and specifications to set accurate customer expectations. Consider implementing quality control improvements based on customer feedback, and regularly review product reviews to identify potential issues before they lead to returns.

Competing with Third-Party Sellers

Vendors often find themselves competing with third-party sellers offering the same products, sometimes at lower prices. This competition can undermine the vendor’s relationship with Amazon and impact sales performance.

Solution: Implement strong distribution controls to prevent unauthorized sellers from accessing your products. Consider enrolling in Amazon’s Brand Registry and utilizing transparency codes or other anti-counterfeiting measures.

Some vendors successfully operate hybrid models, maintaining both Vendor Central and Seller Central accounts to gain greater control over different aspects of their Amazon presence.According to a discussion among Amazon vendors on Reddit, profitability concerns, complex fee structures, and inventory management consistently rank among the top challenges faced by vendors on the platform (Reddit, 2023). Similarly, Pattern.com identifies lack of customer data, advertising costs, complex logistics, and low search rankings as significant pain points for executives selling through Amazon’s 1P model (Pattern, 2022).By acknowledging these challenges and implementing strategic solutions, vendors can navigate the complexities of Amazon Vendor Central more effectively and build a more profitable and sustainable business on the platform.

Vendor Central Success Strategies

Succeeding on Amazon Vendor Central requires a strategic approach that goes beyond simply fulfilling purchase orders. Here are key strategies that successful vendors implement to maximize their performance and profitability on the platform:

Inventory Forecasting Best Practices

Effective inventory management is crucial for Vendor Central success. Amazon expects vendors to maintain high in-stock rates, making accurate forecasting essential. Implement a robust inventory forecasting system that accounts for seasonal trends, promotional periods, and historical sales data. Many successful vendors use a 13-week rolling forecast that they update weekly based on Amazon’s demand planning reports. Additionally, establish minimum threshold alerts to prevent stockouts and maintain buffer inventory for unexpected demand spikes.

Optimizing Product Content

High-quality product content directly impacts conversion rates and search visibility. Invest time in creating detailed, benefit-focused product descriptions, high-resolution images from multiple angles, and comprehensive bullet points that address common customer questions. A+ Content (formerly Enhanced Brand Content) allows vendors to showcase their brand story and product features through enhanced imagery and text placements. According to Amazon, well-optimized A+ Content can increase sales by 3-10% on average (Amazon, 2025).

Building Strong Vendor Manager Relationships

Your Amazon Vendor Manager can be your greatest ally in navigating the complexities of Vendor Central. Establish regular communication channels, be responsive to their requests, and proactively address any performance issues they highlight. Prepare for quarterly business reviews with comprehensive data analysis and growth strategies. Successful vendors often create dedicated teams to manage this relationship, ensuring consistent communication and follow-through on commitments.

Leveraging Marketing Tools Effectively

Vendor Central offers exclusive marketing opportunities that can significantly boost product visibility and sales. Strategically utilize Amazon Marketing Services (AMS) to create sponsored product campaigns, headline search ads, and product display ads. Participate in Amazon Vine to generate initial reviews for new products. For seasonal items, plan Lightning Deals and Deal of the Day promotions well in advance. Consider enrolling eligible products in Subscribe & Save to build recurring revenue streams.

Monitoring and Responding to Performance Metrics

Amazon evaluates vendors on several key performance indicators, including in-stock rate, ship time, defect rates, and customer feedback. Establish a regular cadence for reviewing these metrics and implement rapid response protocols for addressing any issues. Pay particular attention to the Vendor Operations Performance (VOP) score, as poor performance can lead to reduced purchase orders or account restrictions. Create dashboards that track these metrics against Amazon’s expectations and your historical performance.

Seasonal Planning Strategies

Seasonal planning is critical for maximizing sales during peak periods. Begin preparations at least six months before major shopping events like Prime Day, Back to School, and the holiday season. Coordinate with your Vendor Manager to secure promotional placements and increased purchase orders. Ensure your supply chain can handle increased demand by communicating with manufacturers and logistics partners well in advance. Consider creating seasonal variations or bundles of your best-selling products to capitalize on increased shopping activity during these periods.

By implementing these strategic approaches, vendors can build a sustainable and profitable business on Amazon Vendor Central. The platform rewards those who maintain consistent performance, optimize their product presence, and strategically leverage Amazon’s marketing ecosystem to drive sales growth.

Conclusion: Is Vendor Central Right for Your Business?

Amazon Vendor Central offers a unique opportunity for manufacturers and brands to sell directly to Amazon as a wholesale supplier. After examining the platform’s features, benefits, and limitations, it’s clear that Vendor Central presents both significant advantages and notable challenges that businesses must carefully consider.

Summary of Vendor Central Advantages and Disadvantages

The primary advantages of Vendor Central include reduced operational burden, enhanced brand credibility through the “Ships from and sold by Amazon” label, and access to exclusive marketing tools. Amazon handles customer service, fulfillment, and returns, allowing vendors to focus on product development and manufacturing.

However, these benefits come with trade-offs. Vendors surrender pricing control, often face challenging payment terms (typically net-60 or net-90), and must adapt to Amazon’s demanding operational requirements. The wholesale model typically results in lower margins compared to direct-to-consumer sales through Seller Central.

Future Considerations

The Amazon vendor landscape continues to evolve. Recent trends suggest Amazon is becoming more selective with its vendor partnerships, focusing on high-volume, high-demand products. Vendors should anticipate ongoing changes to terms, requirements, and platform features as Amazon refines its business model.

Next Steps for Interested Businesses

If you’re considering Amazon Vendor Central:

- Assess readiness: Evaluate your production capacity, capital reserves, and operational capabilities

- Build Seller Central performance: Strong performance as a third-party seller can lead to a Vendor Central invitation

- Prepare negotiation points: Identify your minimum acceptable terms for wholesale pricing and payment schedules

- Develop a transition plan: If invited, create a comprehensive strategy for the shift to a wholesale model

- Consider professional guidance: Amazon consultants with Vendor Central expertise can provide valuable insights

Ultimately, whether Vendor Central is right for your business depends on your long-term strategy, available resources, and appetite for enterprise-level operations. For many brands, Vendor Central is a valuable channel within a diversified e-commerce approach, but it rarely makes sense as the exclusive solution.

If you want expert support optimizing your Vendor Central journey, contact the Channelinker team for tailored consulting, integration, and ongoing strategy to help you thrive in the changing Amazon marketplace.

Amazon Vendor Central is particularly well-suited for:

- Established manufacturers with robust production capabilities

- Brands with strong wholesale distribution experience

- Companies with sufficient capital to manage extended payment terms

- Businesses seeking to minimize direct customer service and logistics operations

- Brands prioritizing the credibility boost from Amazon’s direct selling

As noted by DCL Corporation, “The most important difference between Amazon Vendor Central and Amazon Seller Central is the point of contact who actually sells your products.” This fundamental distinction shapes every aspect of the vendor relationship with Amazon and should guide your decision-making process. Source

Alternative Options

If Amazon Vendor Central doesn’t align with your business model, several alternatives exist:

- Amazon Seller Central: Maintain greater control over pricing, inventory, and customer relationships

- Hybrid approach: Some brands successfully operate both Vendor and Seller accounts for different product lines

- Direct-to-consumer website: Build your own e-commerce presence outside the Amazon ecosystem

- Other marketplaces: Explore Walmart Marketplace, eBay, or industry-specific platforms

Frequently Asked Questions (FAQs)

What is Amazon Vendor Central and how does it differ from Seller Central?

Amazon Vendor Central is an invite-only platform where brands and manufacturers act as first-party suppliers, selling products directly to Amazon in a wholesale model. In contrast, Seller Central allows businesses to act as third-party sellers, listing products directly to consumers. Vendor Central offers streamlined B2B operations but less pricing and brand control than Seller Central.

How do businesses receive an invitation to Amazon Vendor Central?

Invitations are typically extended to brands with strong sales velocity, high-demand products, or a proven track record on Amazon Seller Central. Focusing on exceptional third-party seller performance and building brand reputation increases your chances of being invited.

What are the advantages of using Vendor Central for B2B sellers?

Vendor Central offers EDI integration, bulk purchasing by Amazon, streamlined invoicing, and access to enhanced analytics and marketing programs. For enterprise B2B sellers, these features facilitate operational efficiency and scale.

Are there any risks or downsides to joining Amazon Vendor Central?

Yes, businesses may face stricter contract terms, limited pricing control, and more complex operational requirements. Changes in Amazon’s partnership strategy or fee structure can also affect profitability. Carefully reviewing terms and negotiating acceptable conditions is essential.

Can Vendor Central be used internationally, such as in Canada or Europe?

Yes, Amazon Vendor Central operates in several global markets including Canada and Europe. However, requirements and program features may vary by region. It’s important to consult local Amazon guidelines and consider using an integration solution like Channelinker for smooth multi-country management.

How can Channelinker support my transition to Vendor Central?

Channelinker provides robust ERP, EDI, and PIM integration for Amazon Vendor Central, helping businesses automate document exchange, manage listings, and optimize performance across multiple regions. Our team offers tailored consulting and implementation support to ensure a seamless Vendor Central experience.